Seemorerocks

Tuesday 9 April 2024

Psychopathy in medicine

Saturday 24 February 2024

“SELF-SPREADING” VACCINES TAKE A DANGEROUS STEP FORWARD

This is the most important and frankly, frightening item of i

nformation that I have seen and so far the only source seems to be

the HIghwire.

I have on seen the following article from iCan, the Highwire’s legal arm.

ICAN UNCOVERS A POTENTIAL NEXT-LEVEL THREAT: “INHALABLE” SELF-SPREADING VACCINES THAT SPREAD LIKE A VIRUS

A new class of “encrypted RNA” vaccines are being developed where the

RNA would piggyback onto an existing wild virus and spread from person to person without any person’s knowledge or consent. Although this may

sound like science fiction, it is far from it. Two companies involved in this research have received millions of dollars from the federal government. A study using this technology on hamsters and the SARS-Cov-2 virus has already been completed and a Phase I trial on humans is in the works.

ICAN’s attorneys have already sent legal demands to all government

agencies involved.

It seems the government and the military are so enthused about this new vaccine deployment technology that Congress tucked a law, the PREVENT Pandemics Act, into the 2023 omnibus appropriations bill to facilitate it. Among other things, the Act has a section dedicated to Platform Technologies that supports the “development

and review of new treatments and countermeasures that use cutting-edge,

adaptable platform technologies that can be incorporated or used in more than one drug or biological product.”

This item on the Highwire discusses this in detail

“SELF-SPREADING” VACCINES TAKE A DANGEROUS STEP FORWARD

Watch HERE

This is how Del Bigtree frames it (from the above video)

He goes on

Here are some of the articles referred to.

https://pubmed.ncbi.nlm.nih.gov/25017994/

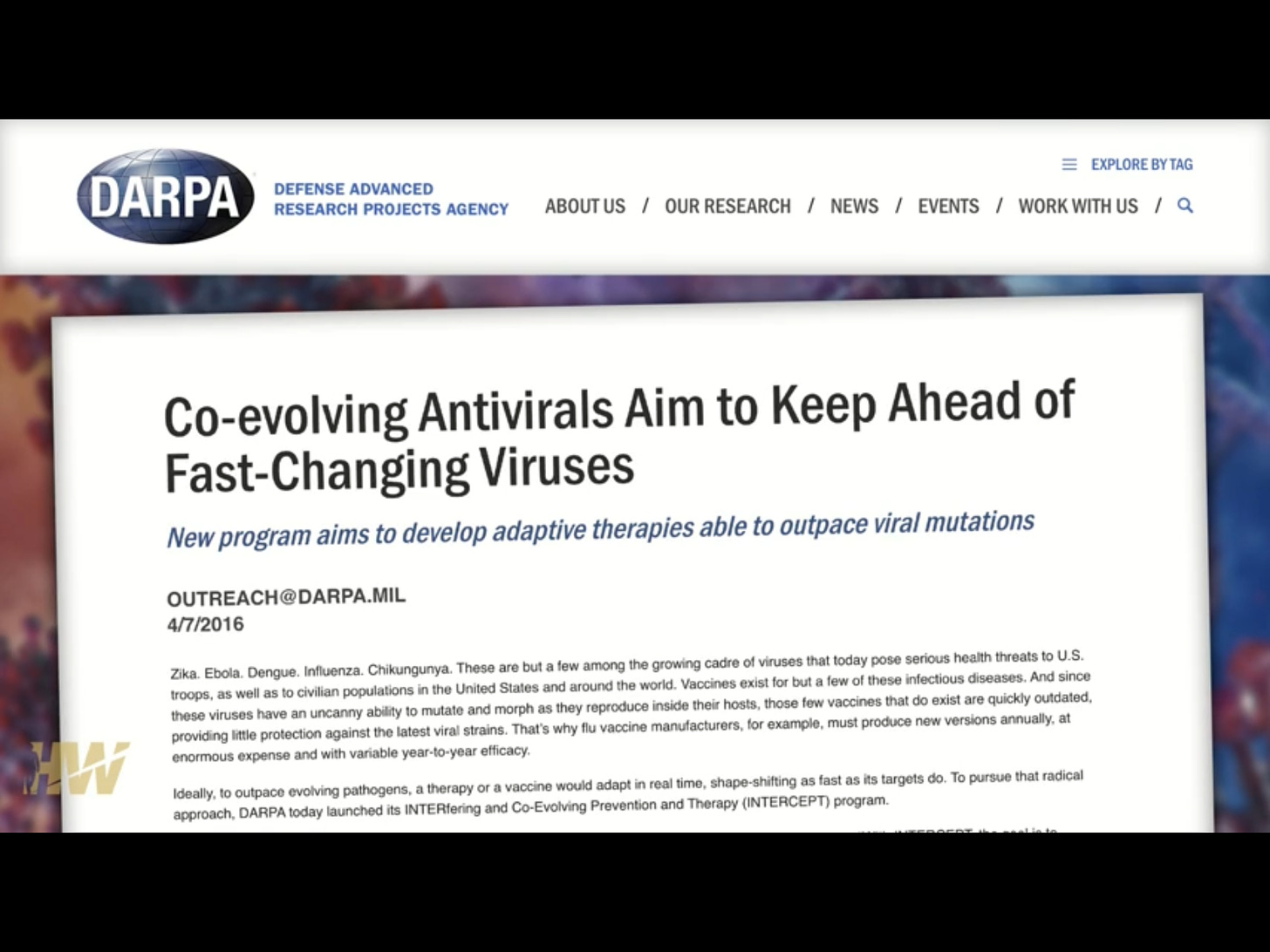

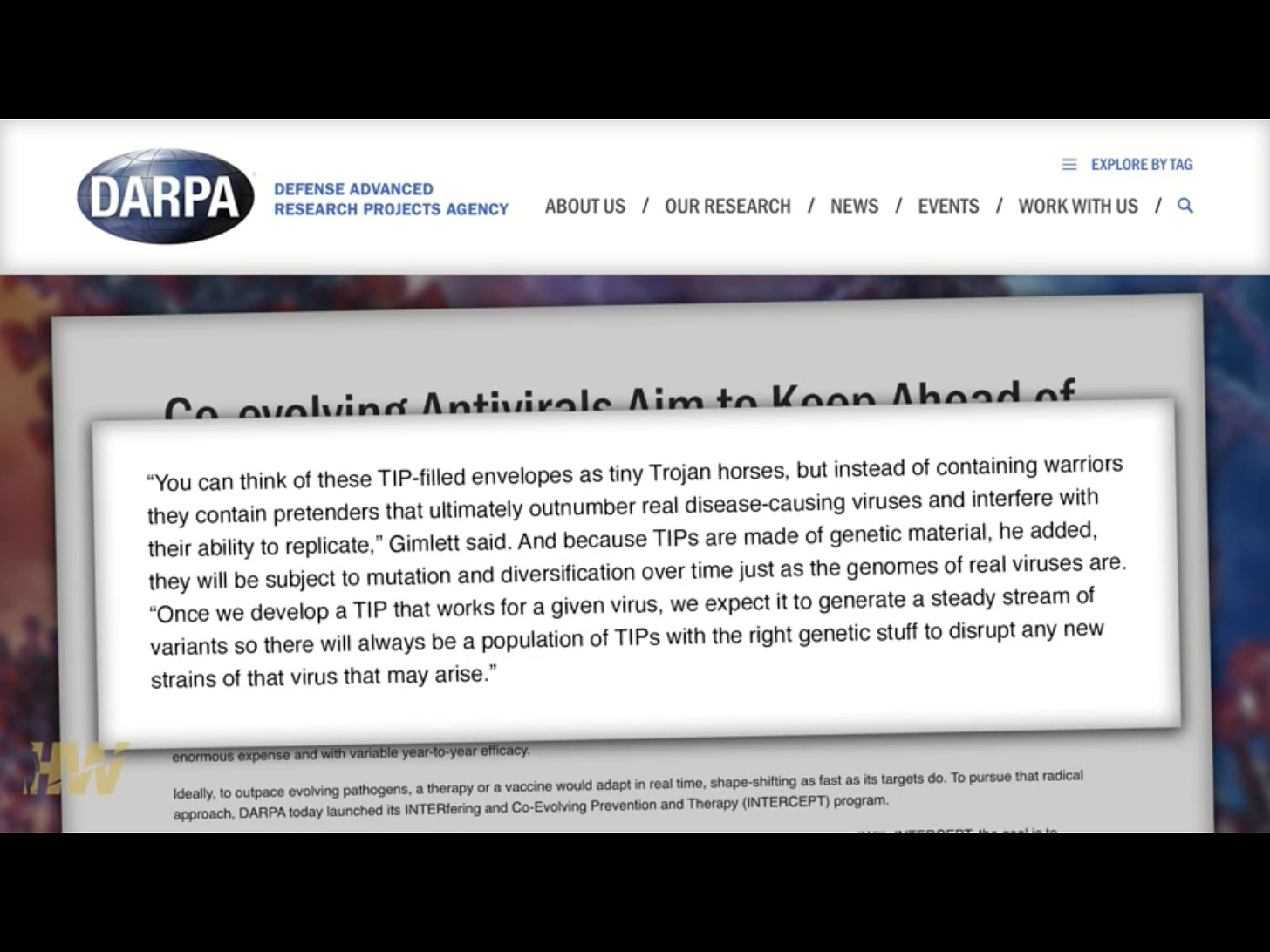

From DARPA

https://www.darpa.mil/news-events/2016-04-07a

DARPA Seeks First-in-Human Therapeutic Interfering Particles Targeting Respiratory Viruses

This shows the official government interest

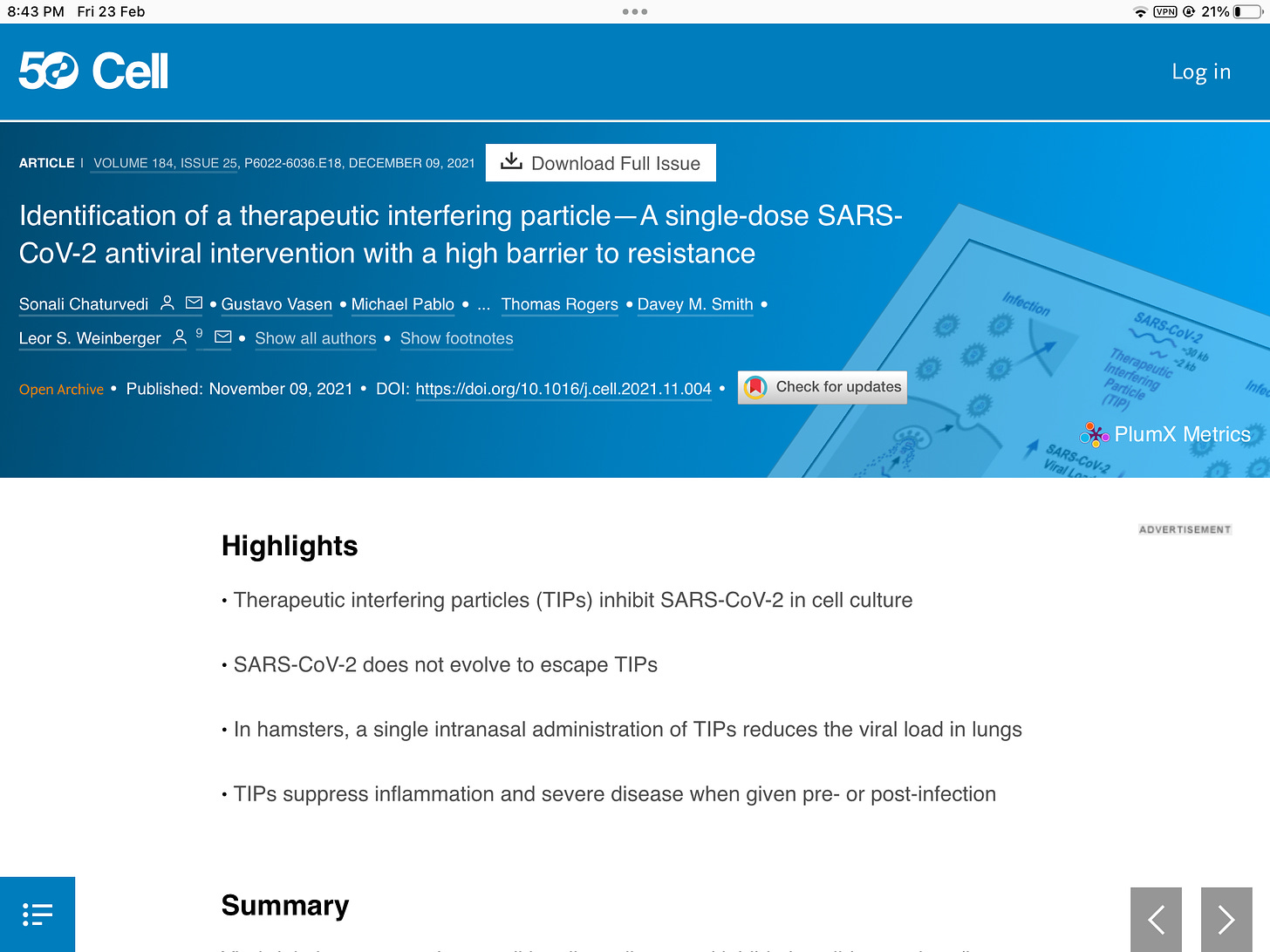

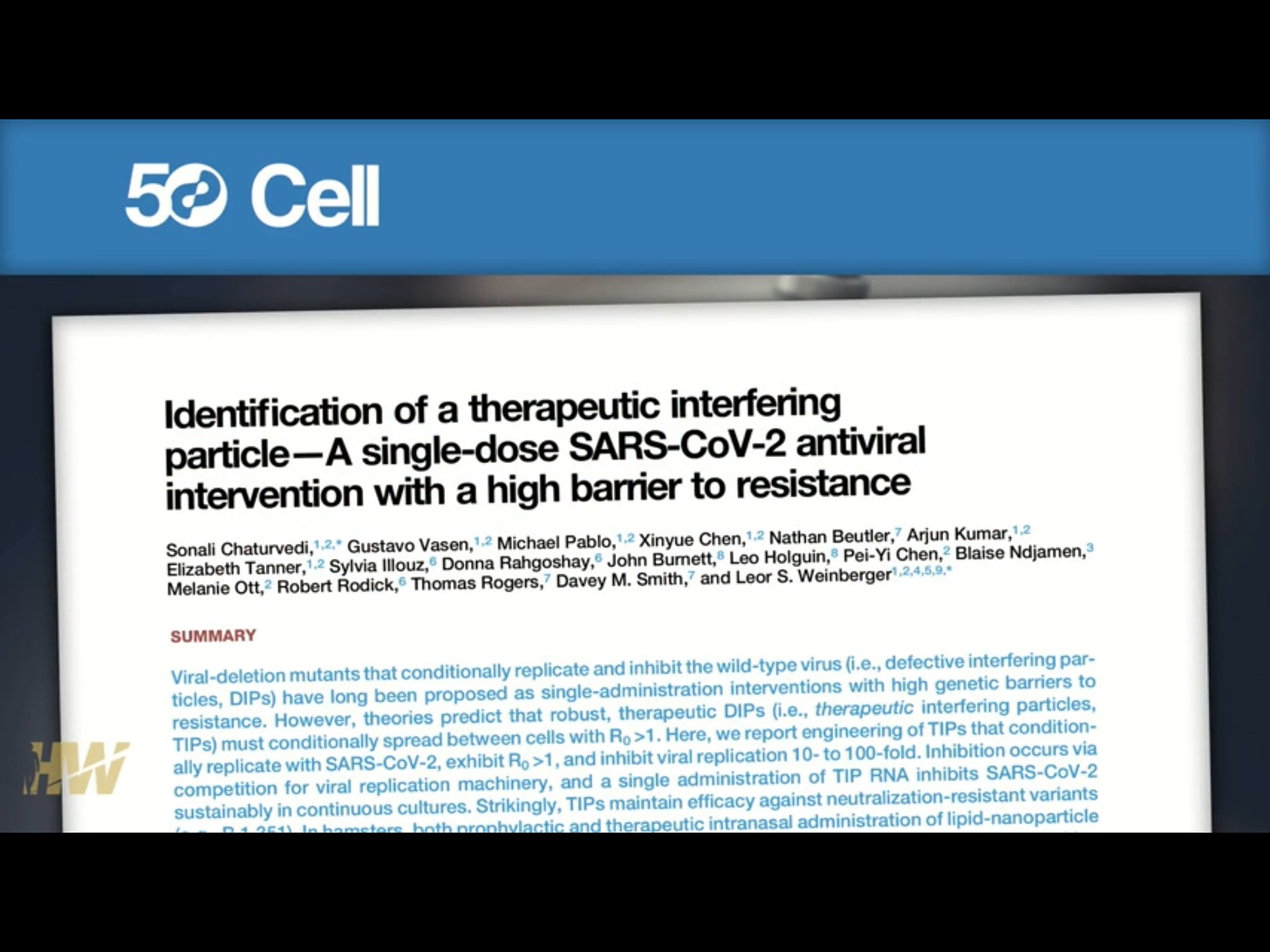

https://pubmed.ncbi.nlm.nih.gov/34838159/

This is the face behind all this, Leor Weinberger

In 2016

Engineering Our Way to Next Generation Therapies

Watch HERE

It has reached the level of government

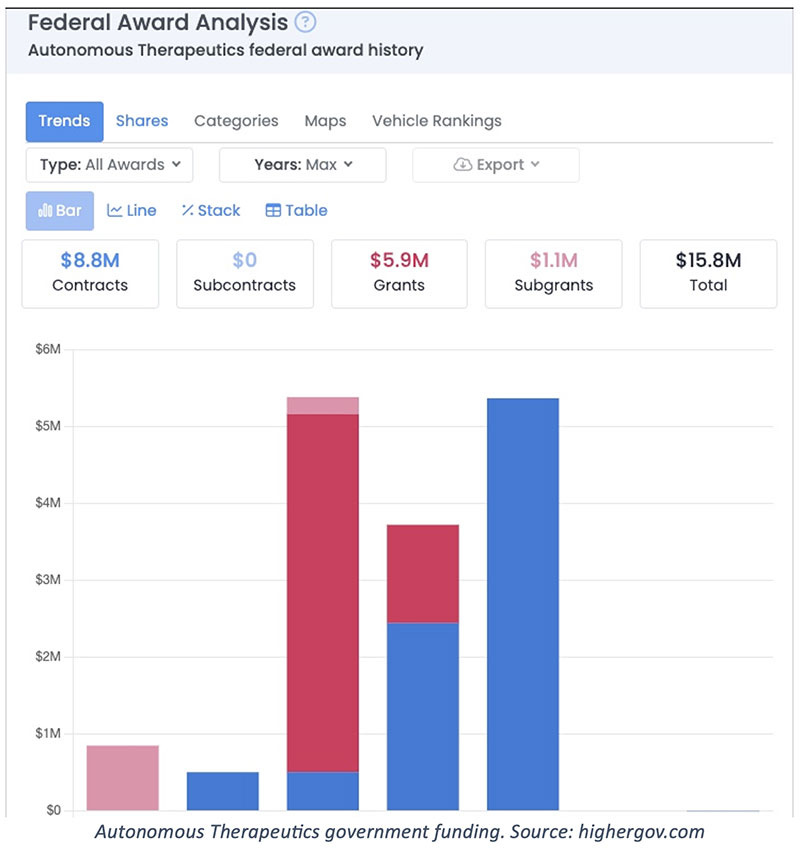

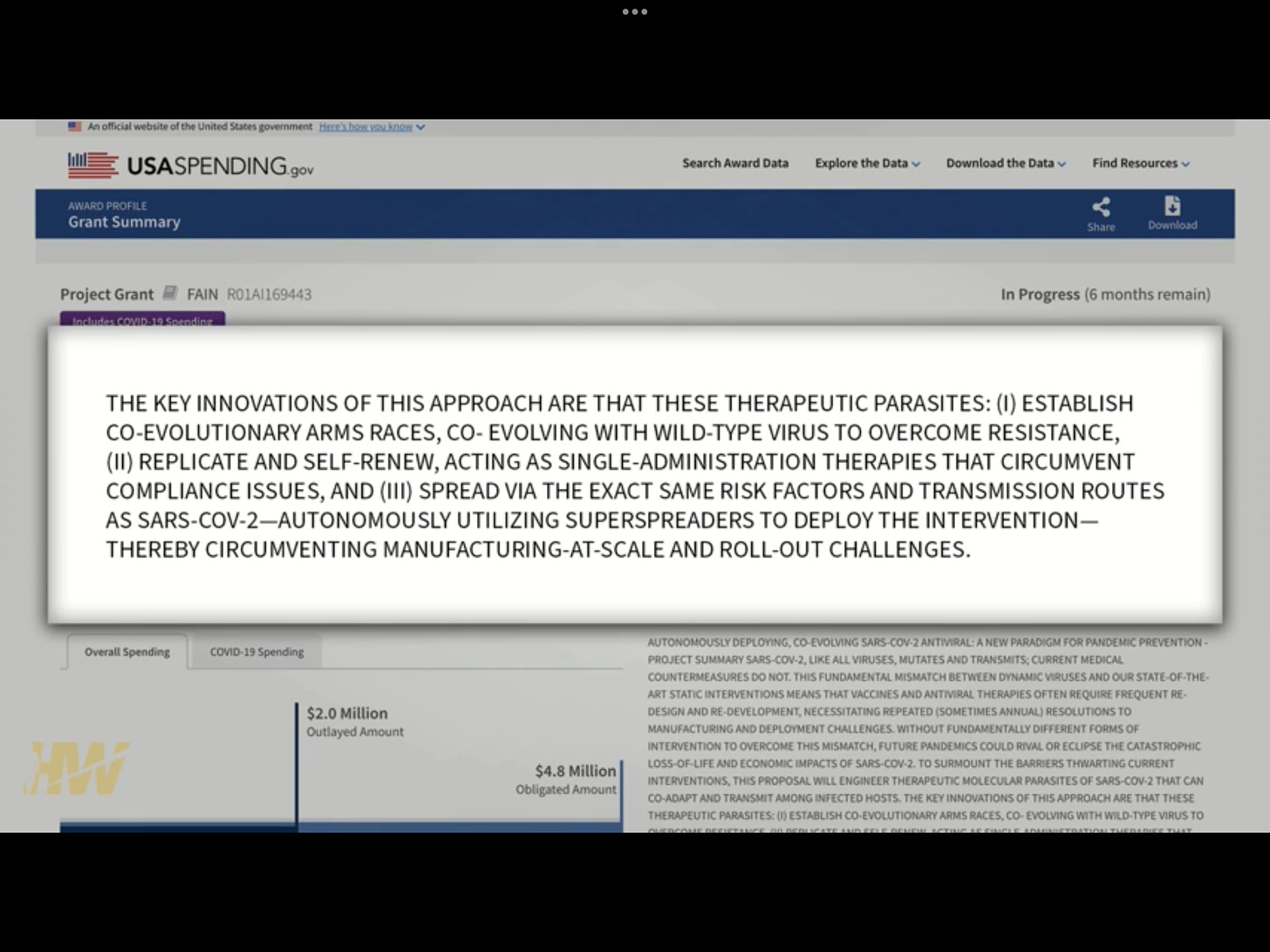

HHS issued a $4.8 million grant to VxBiosciences for “Autonomously Deploying,

Co-evolving SARS-CoV-2 Antiviral.” The grant was for engineering “therapeutic molecular parasites of SARS-CoV-2 that can co-adapt and transmit among infected hosts … acting as single-administration therapies that circumvent compliance issues.”

It has been incorporated into US government legislation

It seems the government and the military are so enthused about this new vaccine deployment technology that Congress tucked a law, the PREVENT Pandemics Act, into the 2023 omnibus appropriations bill to facilitate it. Among other things, the Act has a section dedicated to Platform Technologies that supports the “development and review of new treatments and countermeasures that use cutting-edge, adaptable platform technologies that can be incorporated or used in more

than one drug or biological product.”

Prevent Pandemics Act 2022

What can go wrong?

This is from no less than the World Economic Forum, albeit from back i

n 2015.

Read the article HERE